CIBIL, or the Credit Information Bureau (India) Limited, now known as TransUnion CIBIL, is India’s first Credit Information Company (CIC). It maintains records of an individual’s payments for loans and credit cards. These records are submitted to CIBIL by banks and other lenders every month, and this information is then used to create Credit Information Reports (CIR) and credit scores.

CIBIL’s services are crucial for financial institutions as they assess the creditworthiness of potential borrowers based on the CIR and credit score provided by CIBIL. A higher credit score suggests good credit behaviour and responsible repayment patterns, making it easier for individuals to obtain loans and credit cards.

Some common issues that consumers may encounter with their CIBIL reports include:

- Errors in Personal Information: Mistakes in the spelling of names, incorrect addresses, or other personal details.

- Account-Related Errors: Accounts not belonging to the individual being listed, incorrect account status, or wrong information about credit limits and balances.

- Duplicate Entries: The same loan or credit card account appears multiple times.

- Data Inaccuracy: Outdated information or unrecorded payments affecting the credit score.

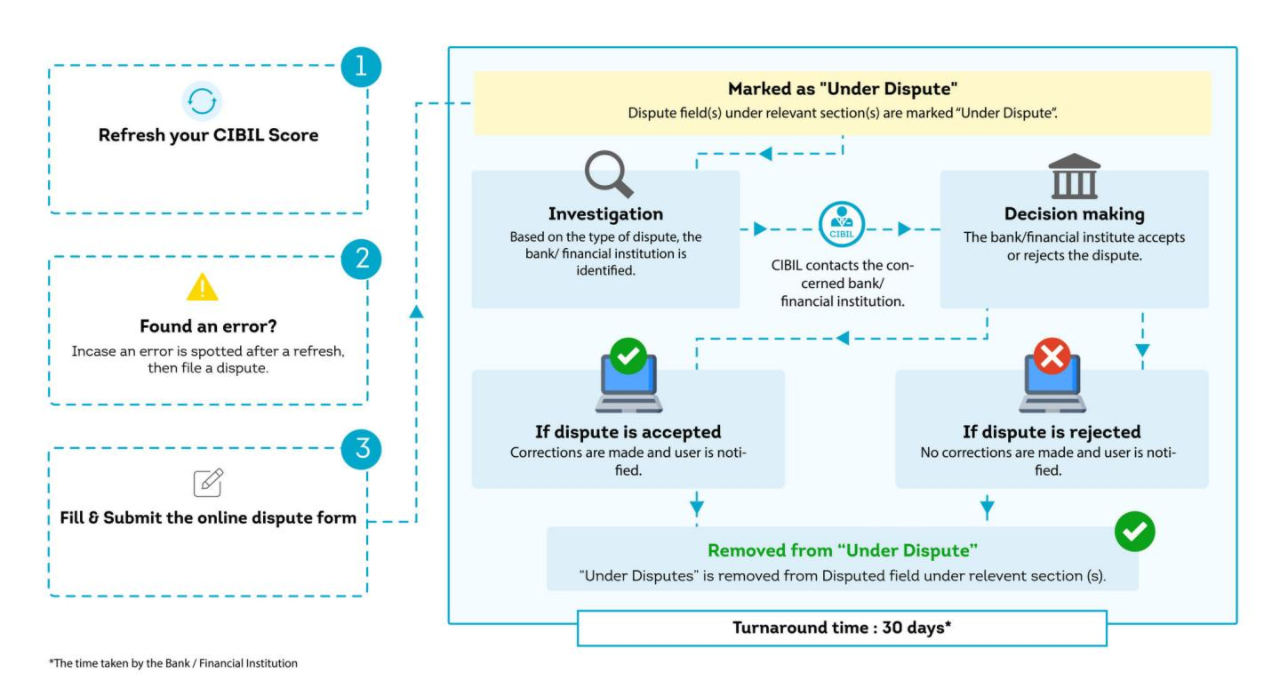

Customers can resolve these CIBIL report problems by filing a complaint with TransUnion CIBIL. Follow the below steps for faster resolution of your dispute.

Registering a Consumer Complaint to CIBIL

If you find inaccuracies in your CIBIL report, you can initiate a dispute resolution process to have them corrected. Here’s a step-by-step guide:

Step 1: Initiate a Dispute

Before submitting a dispute, log in to the CIBIL portal and obtain your latest CIBIL report and credit score. Analyze it carefully for potential discrepancies. Further, you can:

- Log in to your CIBIL account and navigate to the ‘Dispute an Item’ section.

- Refresh your CIBIL Score & Report to ensure you’re referring to the latest information.

Step 2: Complete the Dispute Form

For an online dispute resolution:

- Open “Dispute Center” and log in to your account.

- Fill in the online dispute form carefully, selecting the relevant section you wish to dispute.

- You can raise multiple disputes at once if there are several inaccuracies.

For offline submission, download or obtain the CIBIL dispute form. Complete it with accurate details and attach supporting documents. Mail it to CIBIL’s registered office (provided below).

Step 3: Await the Response

During the grievance resolution process, the case will be escalated to the relevant bank or financial institution to verify the reported information. Further,

- CIBIL will take up the dispute with the concerned lenders based on the type of dispute.

- In some cases, the typical processing time may take up to 30 days.

Step 4: Check Dispute Status

You can check the status of your dispute by logging into your myCIBIL portal. The final resolution may include:

- If the error is confirmed, the relevant information in your CIBIL report will be corrected, and your score may be updated.

- If the information is found to be correct, CIBIL will provide an explanation.

CIBIL Contact Details

For consumer support, use the below communication details of CIBIL:

- Consumer Helpline Number: +912261404300 (Available Monday to Friday, 10:00 AM to 06:00 PM).

- Write to CIBIL: Click Here

- Email: statnotices@transunion.com (for statutory notice)

- Office Address: TransUnion CIBIL Limited, One World Centre, Tower 2A, 19th Floor, Senapati Bapat Marg, Elphinstone Road, Mumbai – 4000132.

If you’re unsatisfied with the resolution, you can escalate the matter to the appointed grievance officer by the CIBIL Escalation Desk, where you can submit an online grievance form. In your grievance form, quote your Service Request Number (SRN) obtained during the initial dispute.

Further, you can use the CIBIL Escalation Desk online form OR write a formal letter or email at nodalofficer@transunion.com to the Nodal Officer of CIBIL’s office. In your letter or email, you may provide your SRN, the Grievance ID of the previous case, and reasons for further escalation.

For any unresolved issues within 30 days or further escalation, you can file a complaint to the Banking Ombudsman under the Reserve Bank of India’s Integrated Ombudsman Scheme.

Remember to provide accurate and complete information when raising a dispute to ensure a smooth resolution process. Keep a record of your dispute reference numbers and correspondence for future reference.

Reference: