Cred, a financial technology enterprise operated by Dreamplug Technologies Pvt Ltd., enables individuals to manage their credit cards with ease and efficiency. Credit card users can access its wide range of financial services, including bill reminders, rewards monitoring, Cred pay, loans, UPI payments, paying bills, and credit score tracking, tailored to suit their needs.

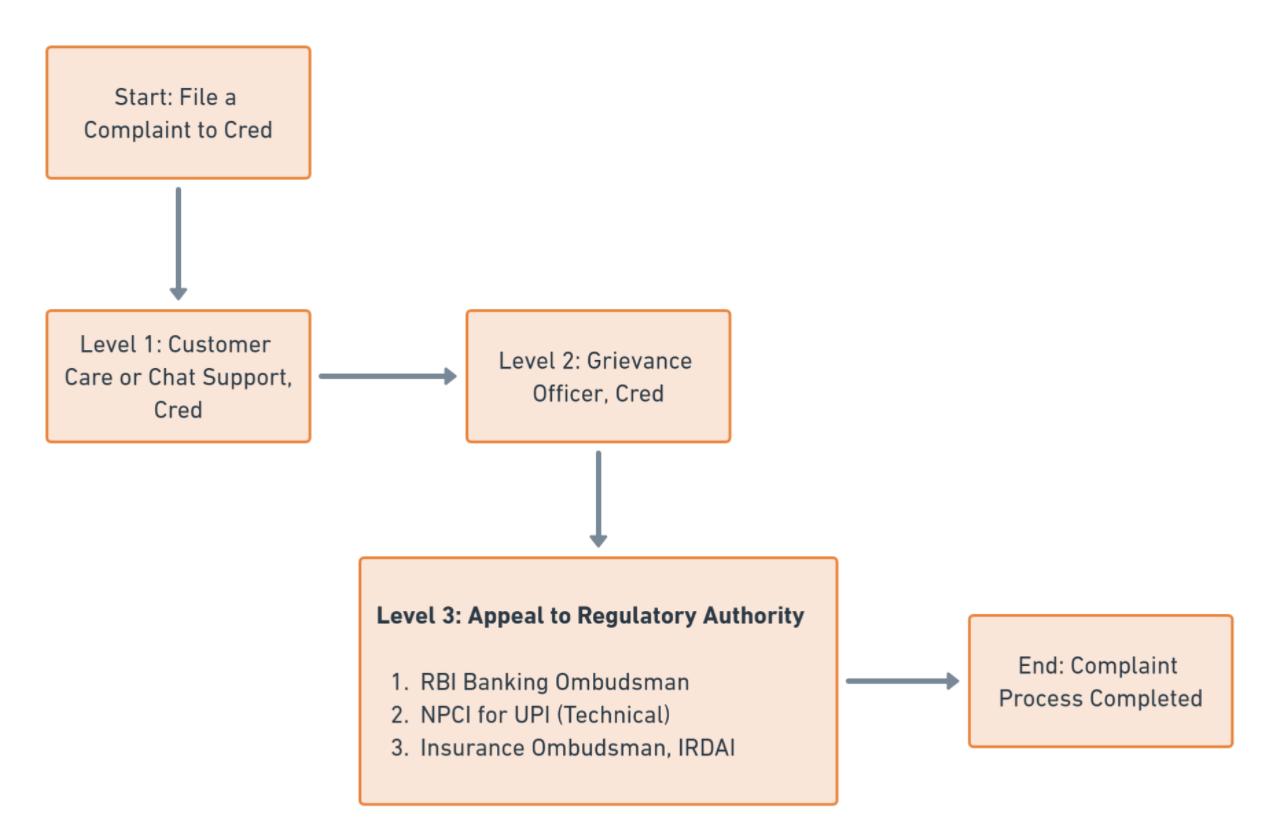

Nevertheless, it is imperative to address any difficulties or dissatisfaction with Cred’s services promptly by filing a complaint. Here, you can find how to register your complaints to Cred support and higher authorities to resolve the matter as per the grievance redressal mechanism.

Here are some common problems faced by most users:

- Transaction Errors: Transactions getting debited but not going through, possibly due to payment gateway failures or bank server issues.

- Credit Card Payment Issues: Payments are not being credited to the card account even after 24 hours.

- Insurance Problems: Two-wheeler insurance not being issued for over a month.

- Refund Delays: Money not refunded for failed transactions.

- Cred Pay: Problems with loans, billing, disputes, Cred Cash, and repayment installments.

- Customer Service: Difficulties in reaching customer support for resolution of issues.

Follow these steps with instructions for filing your complaints with Cred. Additionally, use the below-provided contact details for customer service with communication methods.

Level 1: File a Complaint to Cred Customer Care

Initially, you can raise your concerns with the customer care of Cred using available methods of communication such as customer care number, email, or online complaint form. You can also use official social media channels to message your concerns.

Follow these steps to report your problems.

Step 1: Contacting Customer Support

You can lodge your complaint to the Cred support team using these available communication methods:

1. In-App Chat:

- Open the CRED app and go to the “Get Support” section.

- Tap the “Support” icon.

- Tap “Need more help?” and Start a chat with a support representative.

2. Email:

- Send an email to support@cred.club

- For security concerns, email to security@cred.club

3. Filing an online complaint:

- Visit the Customer Care page of Cred’s official website.

4. WhatsApp:

- Message on +917349798393

For disputes regarding UPI payments, you can also contact your bank and further to the National Payment Corporation of India (NPCI), specifically for technical problems.

Step 2: Provide Required Information

Before contacting support, have the following ready:

- Your CRED account details (if only required).

- Transaction details with date, time, and amount of the transaction in question.

- Nature of the complaint with a clear and concise description of the problem you’re facing.

- Supporting evidence such as screenshots, receipts, or any other documents related to the issue.

Step 3: Clearly State the Issue

- Be specific: Explain the problem in detail concerning the core issue, avoiding vague statements.

- Give relevant background information about the complaint.

- Attach any screenshots, documents, etc. that strengthen your case, as mentioned earlier.

Step 4: Resolution

After the successful submission of your complaint or chatting with the Cred customer service executive, note down the ticket number (in case of email or in-app chat) for future reference to track the status.

If you don’t receive a timely response, politely contact customer support to check the status and ask for a specified timeframe to get a final resolution.

Finally, if your complaint is still not resolved, escalate the disputed matter to the appointed Nodal/Grievance Officer.

Level 2: Escalate to Grievance Officer, Cred

If your lodged complaints are not resolved to your expectations, write a grievance letter to the appointed Grievance Officer to escalate your disputed matter. The complaints may include previously unresolved matters, privacy concerns, or any other Cred disputes.

In your grievance, must provide a reference/ticket ID of the previous complaint with supporting evidence and the expected resolution.

The contact details of the Grievance Officer are:

| Designation | Grievance Officer, Cred |

|---|---|

| grievanceofficer@cred.club | |

| Address | Dreamplug Technologies Private Limited (CRED), 404 Uphar II CHS Ltd., Plot No.5, BHD Sanjeeva ENCL, 7 Bungalows, Near Juhu Circle, Mumbai, Maharashtra 400061. |

For violation of consumer rights by Cred, you have the option to register an informal consumer complaint to the National Consumer Helpline (NCH).

Level 3: Approach the Banking Ombudsman, RBI

If you are dissatisfied with the resolution provided by the Cred customer support team and the Grievance Officer or have not received a response within 30 days, you have the option to escalate the matter to the Banking Ombudsman of the Reserve Bank of India.

You can lodge your complaint against Cred to the Banking Ombudsman’s office by following the instructions and using the contact details provided on the respective page, where you can also find the contact details for your specific region.

- Online Complaint: File a complaint to the Ombudsman RBI

Additionally, you can reach out to other financial regulators based on the nature of your concern:

- Securities and Exchange Board of India (SEBI): For issues related to stocks, securities, and the capital markets.

- Insurance Ombudsman, IRDAI: For complaints regarding insurance policies or providers.

Suggestion

Remember that the customer service representative you’re speaking with is a person, just like you. Being polite and respectful will go a long way in ensuring a positive and productive conversation.

For any incidents of unauthorized transactions, frauds, or payment disputes, report to Cred and respective banks as soon as possible.

When explaining your complaint, be sure to provide all the relevant details, but keep your explanation concise. The more information you can provide, the better the customer service representative will be able to understand and address your issue.

Keeping records of communication such as reference IDs or emails will help you track the progress of your complaint and ensure that you have a record of everything that has been said and done.

Safety Tips:

Don’t share your CRED login or password, or other transaction PIN/OTP and banking information to anyone, even if they claim to be CRED representatives.

Refrain from posting complaints on social media or public forums for everyone to see. This could expose sensitive information.

For privacy, check which data permissions the CRED app has access to on your phone and adjust them if needed.

Finally, read CRED’s privacy policy carefully to understand how your financial data is collected, used, and shared.

Reference: