The Insurance Regulatory and Development Authority of India (IRDAI) was enacted under the IRDAI Act of 1999 by the Parliament of India. It regulates, promotes, and ensures organized growth of the public and private sector insurance & re-insurance businesses.

The major functions of IRDAI are:

| Notice - Be alert! Don't share the financial or banking details and don't share OTP to customer care executive. Protect yourself from Frauds and Scams. Report to Cyber Crime Bureau or Call 1930 as soon as possible to protect your earnings and others. |

- Issues certificates for the new applicants and also can cancel or suspend the registration.

- Protect the interest of the policyholder consumers from the insurer companies and help to ensure a fair and transparent service model.

- Resolve disputes between insurers, intermediaries, and policyholder clients.

- Redress the grievances of the policyholder consumers if the complaints are not resolved by the insurance companies.

- It regulates the activities of the life insurance and general insurance business entities to ensure the larger benefits of policyholders.

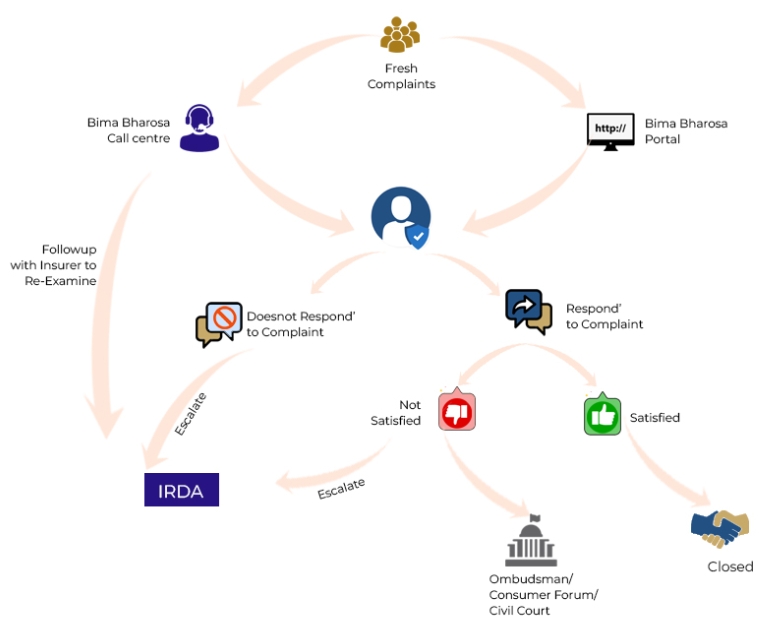

So, if any consumer or policyholder of life insurance or general insurance is facing issues with claims, payments, and other premium payments then file a complaint to the Grievance Cell of the insurance company.

If your complaint is not resolved within 15 days then you can lodge a grievance to IRDAI in the Grievance Redressal Cell and further, you can file a petition to the Ombudsman of IRDAI.

Major complaints that can be redressed by the IRDAI are – Insurance premium payments, claims not accepted, and fraud & scams in the name of insurance. The common issues are – life, and general insurance complaints, EMI for policies, loopholes or defective policies, and any other complaints about service and products of insurance.

You as a policyholder, client, or consumer of insurance services can file a complaint to IRDAI on the toll-free customer care numbers. Send an e-mail or file an online complaint using the official details.

Grievance Registration Fee and Redressal Time by IRDAI:

| Registration Fee | No Charges (0) |

| Redressal Time Limit | Up to 15 working days |

⇒ To know more, read Consumer Handbook of IRDAI

Let us find out the official helpline numbers, e-mails, and the procedure to file a grievance to the IRDAI grievance cell and also know the instructions on how to file a petition to the Insurance Ombudsman of IRDAI.

File a Complaint to the Insurance Regulatory and Development Authority of India

IRDAI (Insurance Regulatory and Development Authority of India) is a regulatory authority that regulates all the insurance companies in India. If the complaints of the policyholders or customers are not resolved by these companies or businesses then they can approach IRDAI.

To take these complaints, IRDAI has provided toll-free customer care and helpline numbers, e-mails, and the online portal Bima Bharosa to the policyholders. You can call these numbers, e-mail the concerns, and also lodge an online grievance.

Further, it has a vigilance office (CVC) where you can file complaints about unethical practices, bribery, or corruption issues by the employees of the government/public insurance companies.

IRDAI Helpline Numbers

Toll-free customer care numbers and helpline numbers of IRDAI Grievance Call Centre IGCC) to lodge a Complaint, ask Queries and get instant Help with insurance services.

| IRDAI Complaint Numbers | 18004254732 |

| Helpline Number | 155255 |

| Office Contact Details of GROs and IRDAI | Click to contact |

Note – If your grievance is not redressed within 15 days then you may file a petition to the Insurance Ombudsman (quasi-judicial body).

Tips – If you want to file a complaint about the services/issues of the department/ministries of the central government, may lodge an online grievance to the CPGRAMS portal of GoI.

Register an Online Complaint on Bima Bharosa, IRDAI

Bima Bharosa is a grievance redressal portal of IRDAI. You can register an online complaint about the services of the insurance companies and their schemes on this portal. Use the links below to raise your concerns.

Steps to file a complaint:

- Visit the link from the table below and open an online insurance complaint form.

- Fill out the personal details.

- Enter the insurance company and policy details.

- Give a brief description of the complaint.

- Upload the policy details and supportive documents (File format (10MB) – DF, JPG, JPEG, and PNG).

- Submit the complaint form and note down the reference/complaint number.

Links to Register an Online Complaint to IRDAI:

| File Online Complaint to IDRAI | Register Now |

| Track Your Complaint Status | Track |

Note – If your grievance is not redressed within 15 days or dissatisfied with the response then you may approach the Insurance Ombudsman.

Tips – For cybercrimes like financial fraud, scams, and other internet crimes, you may file an online complaint to the National Cybercrime Reporting Portal to protect yourself as soon as possible.

E-mail and Official Address of IRDAI

Policyholders can e-mail Bima Bharosa Shikayat Kendra (IRDA Grievance Redressal Cell) or send a post with an application at the official address of IRDAI to lodge a grievance about the services of general and life insurance companies. Don’t forget to mention this information in the grievance e-mail.

Instructions before lodging a grievance by E-mail:

- Provide personal details like name, mobile number, etc.

- Mention the details of the insurance company (Name and policy type).

- Don’t forget to provide the subject of the complaint.

- Give the details of the Policy (Policy/certificate/ claim/ proposal number)

- The type of complaint and a brief description.

- You must attach at least one supportive document and scanned application form with the e-mail.

E-mail and Policy Holder Complaint Registration Form to Lodge a Grievance:

| complaints@irdai.gov.in | |

| Application/Complaint Form | Download/View |

Note – You may file a petition to the Insurance Ombudsman (If the grievance is not redressed within 15 days or not satisfied with the final order of the insurer/IRDAI).

Instructions to File Complaint by Physical Form (Offline):

- Download the above complaint form.

- Fill out the physical complaint form.

- Attach the required documents and policy details.

- Keep a copy of the form for yourself.

- Send the form by post or visit the address given below.

- Don’t forget to e-mail a scanned copy of the form.

Official Address of IRDAI Office

- Address: General Manager, Insurance Regulatory and Development Authority of India (IRDAI), Consumer Affairs Department – Grievance Redressal Cell, Sy. No.115/1, Financial District, Nanakramguda, Gachibowli, Hyderabad – 500032.

Tips – Are the complaints not resolved within 15 days or are not satisfied with the final order of IRDAI or the Insurer company? File a petition to the Insurance Ombudsman.

IRDAI Vigilance for Unethical Practices & Corruption

If unethical practices are being done by the employees of IRDA or involved in any form of corruption, demanding bribes then you may register a complaint to the Vigilance officer (Central Vigilance Commission) of IRDAI.

Official Contact Details of IRDAI Vigilance Office:

| vigilance@irda.gov.in cenvigil@nic.in |

|

| CVC Toll-free Number | 1800110180; 1964 |

Further, you may lodge a complaint to the Central Vigilance Commission (CVC) about any form of corruption, unethical practices, or promoting bribery in any department or office of the government.

File a Petition to Insurance Ombudsman

The insurance Ombudsman comes under the administrative control of the Council for Insurance Ombudsman (CIO) which was constituted under the Insurance Ombudsman Rules, 2017.

Policyholders can file an online complaint to the Insurance Ombudsman if they satisfy these conditions:

- The complaint was not resolved by the life, health, or general insurance company/broker or IRDAI within 30 days.

- The policyholders or you are unsatisfied with the final order or resolution of the complaint.

- The case must not be more than 1 year old.

- The compensation should not exceed Rs. 30 lakhs.

Tips – For more than Rs. 30 lakhs compensation, you can file a petition to E-DAAKHIL of the Higher Consumer Commission/Court.

Links to File Online Petition to Insurance Ombudsman:

| File an Online Grievance to Ombudsman | Register Complaint |

| Track Complaint Status | Track now |

| Office Contact Details | COINS portal |

| inscoun@cioins.co.in |

Instructions & Procedure:

- Visit the link given in the above table.

- Enter your mobile number and verify with OTP.

- Select the category of the company.

- Enter the details of the complainant.

- Provide the details of the complaint/issue (Mention the previous complaint number).

- Upload the documents (Certificate, scanned copy of the previously registered complaint, etc.)

- Finally, tick the declaration form, and submit the online form.

- Note down the acknowledgement number to track the status of the complaint.

If you want to know more about the Council of Insurance Ombudsman, visit the official website or refer to the given references.

Regional Insurance Ombudsman Office Contact Details

The official details (E-mail, address, and phone no.) of the regional Insurance Ombudsman are:

Head Office: Executive Council of Insurers

- Address: Insurance Ombudsman, 3rd Floor, Jeevan Seva Annexe, S. V. Road, Santacruz (W), Mumbai – 400 054.

- Phone: 02226106889, 02226106671, 02226106980

- Fax: 02226106949

- E-mail: inscoun@ecoi.co.in

Regional Offices of Insurance Ombudsman:

1. Ahmedabad

- Address: Office of the Insurance Ombudsman, Jeevan Prakash Building, 6th floor, Tilak Marg, Relief Road, Ahmedabad – 380001.

- Phone: 07925501201, 07925501202, 07925501205, 07925501206

- E-mail: bimalokpal.ahmedabad@ecoi.co.in

2. Bhopal

- Address: Office of the Insurance Ombudsman, Janak Vihar Complex, 2nd Floor, 6, Malviya Nagar, Opp. Airtel Office, Near New Market, Bhopal – 462003.

- Phone: 07552769201, 07552769202

- Fax: 07552769203

- E-mail: bimalokpal.bhopal@ecoi.co.in

3. Bhubaneswar

- Address: Office of the Insurance Ombudsman, 62, Forest Park, Bhubneshwar – 751009.

- Phone: 06742596461, 06742596455

- Fax: 06742596429

- E-mail: bimalokpal.bhubaneswar@ecoi.co.in

4. Chandigarh

- Address: Office of the Insurance Ombudsman, S.C.O. No. 101, 102 & 103, 2nd Floor, Batra Building, Sector 17 – D, Chandigarh – 160017.

- Phone: 01722706196, 01722706468

- Fax: 01722708274

- E-mail: bimalokpal.chandigarh@ecoi.co.in

5. Chennai

- Address: Office of the Insurance Ombudsman, Fatima Akhtar Court, 4th Floor, 453, Anna Salai, Teynampet, Chennai – 600018.

- Phone: 04424333668, 04424335284

- Fax: 04424333664

- E-mail: bimalokpal.chennai@ecoi.co.in

6. Delhi

- Address: Office of the Insurance Ombudsman, 2/2 A, Universal Insurance Building, Asaf Ali Road, New Delhi – 110002.

- Phone: 01123232481, 01123213504

- E-mail: bimalokpal.delhi@ecoi.co.in

7. Guwahati

- Address: Office of the Insurance Ombudsman, Jeevan Nivesh, 5th Floor, Nr. Panbazar over bridge, S.S. Road, Guwahati – 781001 (Assam).

- Phone: 03612632204, 03612602205

- E-mail: bimalokpal.guwahati@ecoi.co.in

8. Hyderabad

- Address: Office of the Insurance Ombudsman, 6-2-46, 1st floor, “Moin Court”, Lane Opp. Saleem Function Palace, A. C. Guards, Lakdi-Ka-Pool, Hyderabad – 500004.

- Phone: 04067504123, 04023312122

- Fax: 04023376599

- E-mail: bimalokpal.hyderabad@ecoi.co.in

9. Ernakulam

- Address: Office of the Insurance Ombudsman, 2nd Floor, Pulinat Bldg., Opp. Cochin Shipyard, M. G. Road, Ernakulam – 682015.

- Phone: 04842358759, 04842359338

- Fax: 04842359336

- E-mail: bimalokpal.ernakulam@ecoi.co.in

10. Kolkata

- Address: Office of the Insurance Ombudsman, Hindustan Bldg. Annexe, 4th Floor, 4, C.R. Avenue, KOLKATA – 700072.

- Phone: 03322124339, 03322124340

- Fax: 03322124341

- E-mail: bimalokpal.kolkata@ecoi.co.in

11. Lucknow

- Address: Office of the Insurance Ombudsman, 6th Floor, Jeevan Bhawan, Phase-II, Nawal Kishore Road, Hazratganj, Lucknow – 226001.

- Phone: 05222231330, 05222231331

- Fax: 05222231310

- E-mail: bimalokpal.lucknow@ecoi.co.in

12. Mumbai

- Address: Office of the Insurance Ombudsman, 3rd Floor, Jeevan Seva Annexe, S. V. Road, Santacruz (W), Mumbai – 400054.

- Phone: 02226106552, 02226106960

- Fax: 02226106052

- E-mail: bimalokpal.mumbai@ecoi.co.in

13. Jaipur

- Address: Office of the Insurance Ombudsman, Jeevan Nidhi – II Bldg., Gr. Floor, Bhawani Singh Marg, Jaipur – 302005.

- Phone: 01412740363

- E-mail: bimalokpal.jaipur@ecoi.co.in

14. Pune

- Address: Office of the Insurance Ombudsman, Jeevan Darshan Bldg., 3rd Floor, C.T.S. No.s. 195 to 198, N.C. Kelkar Road,

- Narayan Peth, Pune – 411030.

- Phone: 02041312555

- E-mail: bimalokpal.pune@ecoi.co.in

15. Bengaluru

- Address: Office of the Insurance Ombudsman, Jeevan Soudha Building, PID No. 57-27-N-19, Ground Floor, 19/19, 24th Main Road, JP Nagar, Ist Phase, Bengaluru – 560078.

- Phone: 08026652048, 08026652049

- E-mail: bimalokpal.bengaluru@ecoi.co.in

16. Noida

- Address: Office of the Insurance Ombudsman, Bhagwan Sahai Palace, 4th Floor, Main Road, Naya Bans, Sector 15, Distt: Gautam Buddh Nagar, U.P-201301.

- Phone: 01202514250, 01202514252, 01202514253

- E-mail: bimalokpal.noida@ecoi.co.in

17. Patna

- Address: Office of the Insurance Ombudsman, 1st Floor, Kalpana Arcade Building, Bazar Samiti Road, Bahadurpur, Patna 800006.

- Phone: 0612-2680952

- E-mail: bimalokpal.patna@ecoi.co.in

Categories of Insurance Complaints

The categories of issues related to Insurance services that can be redressed by the IRDAI and Insurance Ombudsman are:

- The types of policies are – Conventional life insurance, Health insurance, Pension policy, Unit linked insurance policies, crops, credit, fire, Engineering insurance, Motor insurance, Marine hull, and other types.

- Issues in policy – Claims, Cover note related, coverage issues, Death claims, policy-related, policy servicing, premium, and products insurance, proposals, Refund/deposits, and survival claims & ULIP related.

- Other complaints about the insurance companies, unregistered entities, and Insurance intermediaries (broker, insurance marketing firm, corporate agent, etc.).