Tax Information Network (TIN) is a modernized system, established by Protean eGov Technologies Limited. TIN is an initiative of the Income Tax Department of India (ITD) for the various tax collecting, PAN, TAN, e-RI, and other services of direct taxes.

Citizens have to face many issues with the services of the PAN Card and TAN services of TIN. Some residents don’t know the right procedure to get faster redressal of the issues. The official helpline numbers, e-mails, and online portals can be used to resolve complaints.

| Notice - Be alert! Don't share the financial or banking details and don't share OTP to customer care executive. Protect yourself from Frauds and Scams. Report to Cyber Crime Bureau or Call 1930 as soon as possible to protect your earnings and others. |

The Issues of PAN Card That Can Be Resolved by TIN:

- Online application for new PAN card (Form 49A) (Individual or HUF).

- New Pan application (Form 49AA) for Foreign Citizens

- Issues with the reprint of PAN Card

- Change/correction in PAN card

- Issues with document verification

- Other complaints

Have such complaints? Use customer care numbers, and e-mail, and also can write an application to the regional office of TIN. Additionally, file a complaint online using the portal Protean.

Follow all the instructions to lodge a grievance successfully about the issues of PAN card and TAN number allotment.

File PAN Card/TAN/TDS Complaint to the Tax Information Network of Protean

The Income Tax Department of India (ITD) has a system Tax Information Network (TIN) that is managed by Protean (e-governance). TIN is the portal where you can apply online for the PAN card, TDS, and TAN allotment. It also has a grievance redressal system.

You can call the call centers of TIN on the helplines and customer care numbers. Send an e-mail about the issues of PAN linking or personal detail corrections.

Residents can visit the regional offices of TIN and UTIITSL for physical applications of PAN/TAN/TDS and lodge a grievance. Also, file an online complaint on the official portal for faster redressal of the issues.

Grievance Registration Fee & Redressal Time Limit:

| Registration Fee | No Charges (0) |

| Redressal Time Limit | Up to 30 working days |

The instructions and helplines are provided in the sections below, follow these instructions to complain about the online PAN/TAN services.

PAN/TDS Customer Care Number

PAN/TDS call centers are available to provide resolution of the complaints by the customer care numbers. These call centers of the Tax Information Network are managed by Protean. You can raise your complaints about the PAN/TAN application, updating of details, and other problems.

| PAN Customer Care Number (7.00 am to 11.00 pm) |

02027218080 |

| Fax No. | 02027218081 |

| tininfo@proteantech.in | |

| Address | Protean eGov Technologies Limited 4th floor, Sapphire Chambers, Baner Road, Baner, Pune – 411045. |

Note: If your complaint is not resolved within the time limit and not satisfied then you may lodge an online grievance to CPGRAMS or approach the higher authorities at the official branches.

UTIITSL – All India Customer Care Numbers for PAN Services

You can use the all-India customer care number of UTIITSL for PAN applications (if applied on the UTIITSL portal).

| UTIITSL Customer Care Number (PAN) (9.00 am to 8.00 pm) |

+913340802999 |

| utiitsl.gsd@utiitsl.com | |

| UTIITSL Branch Details | Click to contact |

Aykar Seva Kendra Helpline Numbers and E-mail

If any person has an issue with the income tax services and PAN card verification, or Aadhaar linking then you can call on the customer care numbers of Aykar Seva Kendra. You may e-mail your grievance about the PAN issues.

| Customer Care Number |

18001801961; 1961 |

| ask@incometax.gov.in | |

| Tax Helplines | Click to contact |

You may also register an online complaint about the PAN/TAN/ TDS services on the official portal.

Register an Online Complaint

Citizens can use the online portal of the Protean (Tax Information Network)/NSDL to register an online complaint about PAN/ TAN/ TDS services. Visit the link to lodge a grievance to get redressal of issues like PAN application and other updation problems.

Online PAN/TDS Complaint:

Procedure:

- Visit the link: https://www.protean-tinpan.com/customerfeedback.html

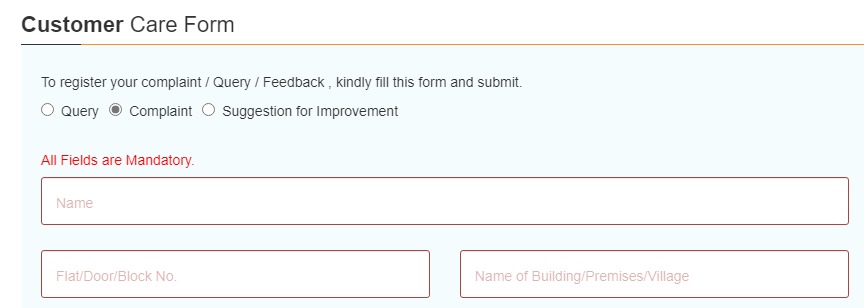

- Select the ‘Complaint’ option on the Customer Care Form.

- Fill out all the required information.

- Select the category of the complaint (PAN, TAN, or TDS).

- Provide a brief description of the issues related to PAN cards.

- Enter the captcha and submit the online complaint form.

- Note down the reference number to track the status of the complaint.

Note – If your grievance is not resolved or unsatisfied then you may approach CPGRAMS and the higher authority of the NSDL/TIN.

Visit the official portal for Do or Don’t Do instructions of TIN/NSDL.

Head Office and Branches of Protean/NSDL (TIN)

You may approach the head office or the regional branches to file a complaint about PAN/TAN services. Also, residents can apply for the new PAN card/TAN by physical forms at these offices of the Tax Information Network of Protean/NSDL.

TIN-NSDL Head Office:

- Address: Times Tower, 1st Floor, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai, Maharashtra, PIN – 400013.

Branch Offices

Contact regional branch office:

| Region | Contact Details |

|---|---|

| New Delhi | Phone No.: 01123705418; 01123353817 Fax: 01123353756 Address: 409/410, Ashoka Estate Building, 4th floor, Barakhamba Road, Connaught Place, New Delhi 110001. |

| Chennai | Phone No.: 04428143917; 04428143918 Fax: 04428144593 Address: 6A, 6th Floor, Kences Towers, #1 Ramkrishna Street, North Usman Road, T. Nagar, Chennai – 600017. |

| Kolkata | Phone No.: 03322814661; 03322901396 Fax: 03322891945 Address: 5th Floor, The Millenium, Flat No. 5W, 235/2A, Acharya Jagdish Chandra Bose Road, Kolkata – 700020. |

| Ahmedabad | Phone No.: 07926461376 Fax: 07926461375 Address: Unit No. 407, 4th floor, 3rd Eye One Commercial Complex Co-op. Soc. Ltd., C. G. Road, Near Panchvati Circle, Ahmedabad, Gujarat– 380006. |

References: