The Life Insurance Corporation of India is a government-owned public-sector insurance company. LIC was established in September 1956 under the Life Insurance Corporation Act, 1956. The major insurance services are available all over India and also for foreign citizens.

The Insurance Services of LIC are life insurance plans, pension plans, micro insurances, deposits, health insurance, government insurance schemes (PMJJBY, PMJDY, etc.) and other plans. It also provides facilities for loans, long-term deposits, SIIP-based investments, and many other financial services.

| Notice - Be alert! Don't share the financial or banking details and don't share OTP to customer care executive. Protect yourself from Frauds and Scams. Report to Cyber Crime Bureau or Call 1930 as soon as possible to protect your earnings and others. |

If you are a customer of LIC or a policyholder and facing an issue with the services of LIC then you can register complaints to the authorities. For this, policyholders or any person can call on the toll-free customer care number (helplines), e-mail or file an online complaint on the grievance portal of LIC.

The Issues of the Services:

- Conventional Life Insurance Policy: Related to claims (death claims or maturity claims), premium or account statement issues, reinvestment related, proposal processing, payment or refund issues, annuity or pension not paid, branch transfers, and other policy-related complaints.

- Health Insurance Policy: Death claim settlement or other related claims (pending or other issues), due premium, the amount deducted but not yet updated, health insurance related to any complaint or other issues.

- Pension and Unit Linked Insurance Policy: Unfair practices in the insurance policy, pension premium is pending or pension is yet not paid by the LIC authority. approval or denial issues, and other pension and unit-linked insurance complaints.

- Other Grievances: Unethical practices by the employees or agents of LIC, higher charges, denial of payment receipt, demand for the commission, and other types of complaints.

Your complaints will be resolved as per the specified procedure of LIC. Policyholders can also contact the regional branch to register complaints in the written application. If not resolved, you can escalate the grievance to the higher authorities and zonal branch.

The e-mail and helpline numbers of the various branches of the LIC are provided here. You can use these grievance registration details for the successful redressal of your issues.

Tips – If you are not satisfied with the final responses of the LIC then you can lodge a petition to the Insurance Ombudsman of your zone. policyholders can also approach the Insurance Regulatory and Development Authority of India (IRDAI).

How to Register a Complaint to the Life Insurance Corporation of India (LIC)?

LIC has a fast and transparent grievance redressal system to resolve the complaints of the policyholders (customers) and the service users. You can visit the regional branch of your circle or can call on the LIC helpline number to raise your concerns. Even you can use the LIC portal to register an online complaint to the concerned department or branch.

Complaint Registration Fee and Redressal Time Limit by LIC:

| Registration Fee | ₹0 (No Charges) |

| Redressal Time Limit | Up to 15 working days |

⇒ To know more, read Citizen Charter of LIC

Customers can send an e-mail to raise their grievances about the insurance policy, payment, refund, claim, and other issues. Further, you can escalate to the higher authorities (Branch Manager, Regional Head Branch, and Zonal Branch).

The time limit is specified in each stage, if it exceeds then you can escalate the registered complaint to the higher Grievance Redressal Officers (GROs). Further, you may approach the IRDAI and Insurance Ombudsman.

LIC Toll-Free Customer Care Number

Policyholders can use the helpline numbers for inquiries, queries, and help, and also can register complaints. Call on the LIC toll-free customer care number to raise your concerns and learn more about the services.

Toll-Free LIC Customer Care Numbers:

| LIC Complaint Number | +9102268276827 |

| Regional Customer Zones Helpline Numbers | View/Contact |

| SMS LICHELP (‘LICHELP <pol. no.>’) |

9222492224 56767877 |

Toll-Free Customer Care Numbers of Health India Insurance TPA Services Pvt. Ltd for Health Claim:

| Health Insurance Customer Care Number | +918976923091 |

| Sr. Citizen Helpline Number | +918976923092 |

| helpdesklic@healthindiatpa.com |

Note – If your complaint is yet not resolved you can register online by Integrated Complaints Management System (ICMS) of LIC. You can also escalate the complaint to the LIC Branch Manager of your circle by e-mail or in the written application. Get details from the section below.

Lodge Online Complaint to LIC

LIC has provided an Integrated Complaints Management System (ICMS) where any policyholder can register an online complaint about the insurance policies, payment, claims, and unethical practices in the policy or business. You can also use the LIC customer app to lodge your grievance.

Links to Register Online Complaint to LIC:

| Lodge Online Complaint to LIC | File Complaint |

| LIC Branch Office GROs E-mails and Contact Numbers | View/Download |

| LIC Portal Helpdesk (Complaint) | Click Here |

| For Unethical Practices/Corruption | Vigilance Officer |

Alternative Options:

| Mobile App | Customer App: Android | iOS MyLIC: Android | iOS |

| Social Media | Twitter | Facebook |

Note – If your complaint is not resolved within 15 days or not satisfied with the final response then you can e-mail, write an application, or call the Manager at the Divisional Office of LIC. Please mention the complaint number or reference number of the previously registered complaints.

Procedure to File an Online Complaint by LIC ICMS:

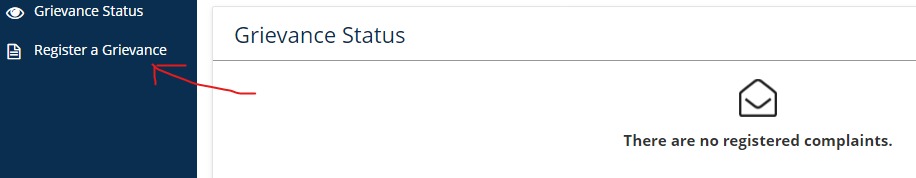

Step 1: Visit the link (file Complaint) from the table above, and sign up or log in. You can now see the dashboard.

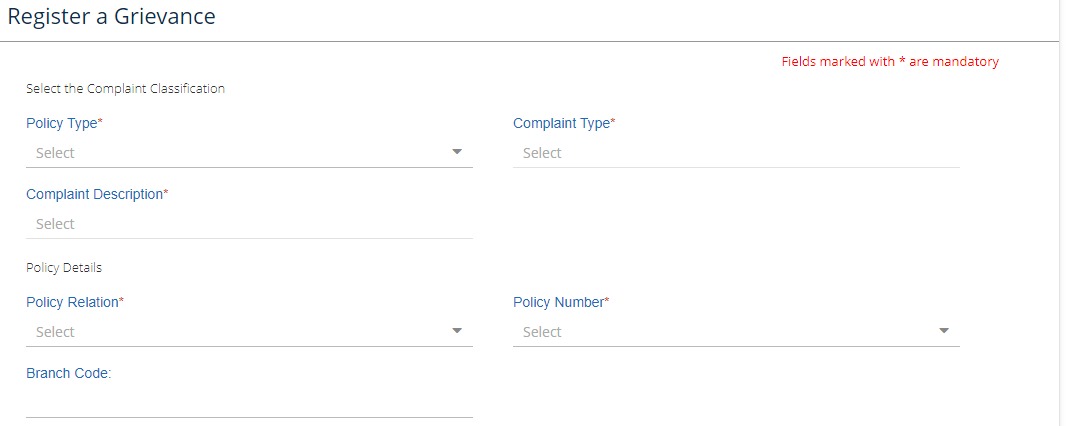

Step 2: Click the ‘Grievance’ option as shown in the image. From the grievance dashboard, click the ‘register a grievance’ shown in the menu.

Step 3: Fill out the online grievance form with the required information and also describe issues and details of the complaint. Finally, submit the form.

Step 4: After successful registration of your complaint, note down the reference number or ticket number to track the grievance. For this, you just need to login and visit the same grievance section and select the ‘grievance status’ from the menu.

Note – If your complaint is not resolved or not satisfied with the final response then escalate the complaint by using the reference number to the higher grievance redressal officers as mentioned below.

Important Online Services of LIC

LIC has provided an online portal so customers can easily access insurance services and get benefits by following some simple steps. Some important online services are – online premium payment, applying for claims, downloading claims and other forms, applying for new policies, and others.

Links of LIC Portal for Online Services:

| Pay Online LIC Premium | Pay Now |

| Download LIC Claim/Pensioner Help and Other Forms | View/Download |

| Policy Guidelines and Helpline | Click to read |

| LIC Policy Premium Calculator | Click to calculate |

File Complaint to Higher Grievance Redressal Officers of LIC: Escalation Level

If your previously registered complaint is not resolved or is pending more than 15 days then you can file a complaint to the higher authorities by escalating the registered grievance. Even if you are not satisfied with the final responses then also you can lodge a grievance.

Level – 1

The E-mail and Contact Details of the Manager (CRM) at the Divisional Office of LIC:

| Manager at Divisional Office | View/Download |

Steps: Send an e-mail or write an application to the officer. Also, mention the reference number or docket number of the previously registered complaints. In the application, mention the policy number, description of the issue, and personal contact details (attach documents if required)

Level – 2

Zonal Grievance Redressal Officers – E-mail, Phone Number, and Address of Regional Manager (CRM):

| Zone (LIC) | E-mail, Phone No., and Covered States & UT |

|---|---|

| Northern Zone HQ- New Delhi |

011-49841705 nz_rmcrmps@licindia.com Cover: Haryana, Himachal Pradesh, Jammu & Kashmir, Ladakh, Punjab, Delhi, Chandigarh, and, Rajasthan. |

| North Central Zone HQ- Kanpur |

0512-2314594 ncz_rmcrmps@licindia.com Cover: Uttar Pradesh, Uttarakhand. |

| Central Zone HQ-Bhopal |

0755-2676222 cz_rmcrmps@licindia.com Cover: Chhattisgarh, Madhya Pradesh. |

| Eastern Zone HQ- Kolkata |

033-22126312 ez_rmcrmps@licindia.com Cover: Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, West Bengal, and Andaman Nicobar. |

| South Central Zone HQ- Hyderabad |

040-23235613 scz_rmcrmps@licindia.com Cover: Andhra Pradesh, Telangana, Karnataka. |

| Southern Zone HQ- Chennai |

044-28604122 sz_rmcrmps@licindia.com Cover: Kerala, Tamil Nadu, Puducherry, Lakshadweep. |

| Western Zone HQ- Mumbai |

022-22825980 wz_rmcrmps@licindia.com Cover: Goa, Gujarat, Maharashtra, Dadra Nagar Haveli, Daman & Diu. |

| East Central Zone HQ-Patna |

0612-2503035 ecz_rmcrmps@licindia.com Cover: Bihar, Jharkhand, Odisha. |

Note – Not satisfied or unresolved complaint within 15 days? Escalate the grievance at level 3 the central grievance office of LIC.

Level – 3

Corporate Grievance Redressal Officers: Escalate Registered Grievance to Executive Director of Center Office, LIC.

| Nature of Grievance | E-mail, Phone No., and Office |

|---|---|

| Policy Services – Conventional Policies | 022-22029593 co_complaints@licindia.com Office: CRM HQ- Mumbai. |

| Conventional New Policies | 022-22024597 ed_nb@licindia.com Office: New Business and Reinsurance, HQ-Mumbai. |

| Group Schemes/ Annuity Policies | 022-22028493 ed_pgs@licindia.com Office: P & GS, HQ- Mumbai. |

| Agents, Development Officers, and Intermediaries | 022-22027527 co_mktgcomplaints@licindia.com Office: Marketing and Product Development, HQ- Mumbai. |

Note – If you are not satisfied with the final order or resolution of these grievance officers then you can lodge an online complaint to IRDAI (Insurance Regulatory and Development Authority of India).

Insurance Ombudsman, CIO

If your complaint is not resolved by the central grievance redressal officers within 15 days or as specified by the officers of LIC or not satisfied with the final order then you can register an online complaint to IRDAI (Insurance Regulatory and Development Authority of India) by using e-mail or online portal Bima Bharosa.

Further, you can file a petition or online complaint to the Insurance Ombudsman at the Council of Insurance Ombudsman portal. To lodge a grievance to IRDAI and Insurance Ombudsman click the link below.

Click: File an Online Complaint to IRDAI and Insurance Ombudsman

Tips – Yet not satisfied with the final redressal of your grievance then you may approach National Consumer Disputes Redressal Commission (NCDRC) and further the legal courts (high court or supreme court).

Time Limit for Insurance Policies and Services of LIC

The time limit as per the policy servicing benchmarks specified by the LIC in the Citizen Charter are:

| Types of the Service | Time Limit |

|---|---|

| Cancellation/surrender/Withdrawal/Request of proposal deposit/Refund of the outstanding proposal (subject to receipt of all documents) | 15 days |

| Maturity claim, Survival benefit, Annuity, or Pension | on or before the due date |

| Raising claim requirements after lodging the claim | 15 days |

| Death claim settlement without investigation requirement | 30 days |

| Death claim with the investigation report | 120 days |

| Issuance of policy document after acceptance of the proposal | 5 days |

| Registration of nomination, Assignment, Re-assignment, and return of policy document | 3 days |

| Effecting revival, alteration, and issue of duplicate policy on receipt of all requirements | 2 days |

| Loan settlement after receipt of all requirements | 3 days |

| Intimation of the status of SSS policies | One year + Bonus information |

| Effecting change of address or transfer In-Out and other inquiries under the policies | Same day |

| Acknowledge the number/receipt of the registered grievance | 3 days |

| Resolution/redressal of a registered grievance (complaint) | 15 days |

Note – To know more, read the citizen charter of LIC. The link is provided in the above section.