PhonePe Private Limited is a digital payment and financial technology company, incorporated under the Companies Act, of 1956, owned by Flipkart, a subsidiary of Walmart. PhonePe was founded in 2015 and currently is headquartered in Bangalore, Karnataka. It allows making and transferring payments through UPI (Unified Payments Interface) and PhonePe Wallet.

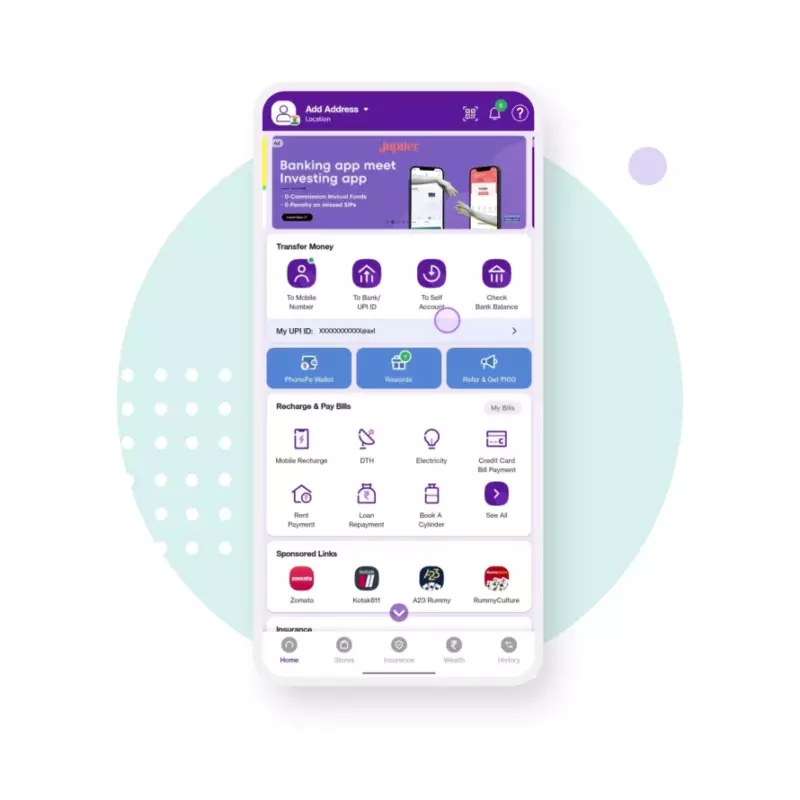

Some financial services of the PhonePe app are payment transfers, recharge of mobile & DTH, bill payments (electricity, postpaid, gas, water, credit card, etc.), and booking of tickets for movies, events, and flights. Customers can also link bank accounts, debit cards, and credit cards to make payments & transfer money to other accounts.

| INDEX |

Want to register a complaint with PhonePe? Yes! Customers or PhonePe users can contact customer care representatives through toll-free customer care numbers, e-mail, and online chat support (PhonePe app). You may also file an online complaint via the web portal. If not resolved, escalate the disputed case to the Nodal Officer, PhonePe Pvt. Ltd.

Other financial products of PhonePe include:

- Business Solutions: Payment gateways, PhonePe Switch, and Merchant (smart speaker, POS, or Express checkout)

- Insurance: Life insurance (term, accident, and travel insurance), Vehicle insurance (Motore, bike, or car), and Health insurance

- Investments: Mutual funds, gold & tax saving funds, and equity & security funds (equity, debt, and hybrid)

Do you know where should file a complaint? If not, you should know the grievance redressal mechanism of PhonePe. As per the grievance redressal policy of PhonePe Pvt. Ltd., the whole complaint resolution process is divided into 4 levels.

First, register a complaint with PhonePe customer support through the PhonePe app (mobile) in level 1. If not resolved within 3 business days, escalate it to the customer care representative by toll-free number or e-mail in level 2.

Not resolved within 3 business days? Now, you can escalate this unresolved or unsatisfactory complaint to the Nodal Officer (Grievance Officer), PhonePe in level 3. Yet not resolved?

If the disputed grievance is not resolved within 30 days (including the total days of levels 1 to 3) by PhonePe Officials, file a complaint with the Banking Ombudsman (BO), Reserve Bank of India (RBI).

Note – But, if the matter belongs to investment (stock market, debt, and securities), register a complaint with the Security and Exchange Board of India (SEBI). For the violation of consumer rights, file a complaint to the National Consumer Helpline (NCH), Ministry of Consumer Affairs.

How to Register a Complaint to PhonePe Private Limited?

The Grievance Policy of PhonePe is designed to resolve customer complaints and disputed issues with the products and services of the company. Do you want to complain? You can do it by following the mechanism to redress any concerns. If the problems are not resolved, the escalation matrix defines the resolution process with respective officers.

| Complaint Registration Fee and Redressal Time – PhonePe | |

|---|---|

| Registration Fee | ₹0 (No Charges) |

| Resolution Time | Within 30 days (read the grievance policy of PhonePe to get more information) |

| Refund Period | 3-10 working days |

The service level to resolve any complaints is divided into 4 levels. As per the PhonePe grievance policy, the issues of services like recharge, bill pay, PhonePe wallet, Phonepe gift cards, UPI (Unified Payments Interface), payments & transactions, stores, investments, PhonePe switch, and vouchers, will be resolved by the customer representatives and officers/authorities of these levels.

The Ways to Complain with PhonePe:

- Customer care number (call the support center)

- E-mail (Write to customer support)

- Complaint online (live chat) – PhonePe app, online form, and web portal

- Write a complaint letter – Regional/HQ office

Grievance Escalation Matrix (4 Levels):

Level 1:

- This is the initial stage to register a concern or complaint about any financial services & products of the company.

- Call customer support or raise a concern with a PhonePe customer care representative by the (?) icon on the mobile app.

- The resolution period of the complaint is 3 business days (support available 24/7)

- The complaints of ‘fraud and risk assessment’ may take longer time due to investigation by various agencies.

- If not resolved within 3 days or if dissatisfied with the final resolution, escalate it to level 2.

Note – After successfully registering a complaint, note down the reference/ticket number to track the status and use it to escalate unresolved/unsatisfactory grievances.

Level 2:

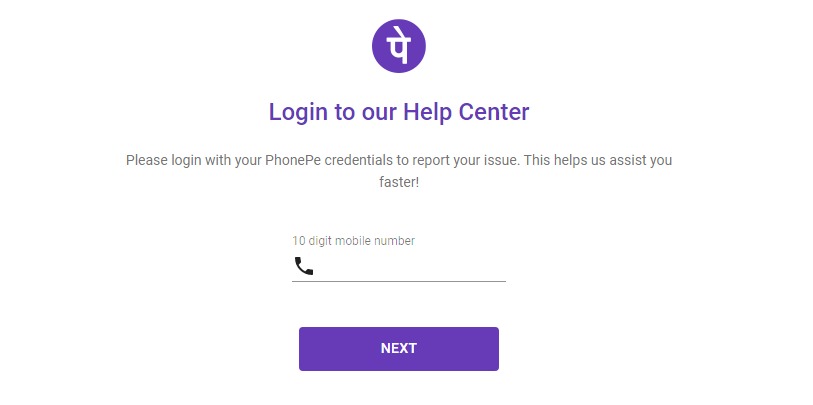

- At this level, escalate the complaint to the customer support center with a reference/acknowledgement number through toll-free PhonePe customer care number, e-mail, online complaint form (filing via website), or mobile app.

- The complaints of level 2 will be resolved within 3 business days. If this does not happen, escalate to the Nodal Officer of level 3.

Level 3:

- According to the rules of the Information Technology Act, 2000, PhonePe has appointed Nodal Officer where you can escalate the unresolved complaints of level 2.

- This grievance officer will ensure that the complaints should be resolved within 7 business days. If delayed, will be notified of the reason.

- Not resolved? Are you dissatisfied with the final resolution? File a complaint to Ombudsman, RBI in level 4.

Level 4:

- If your complaint or any query has not been resolved within 30 days or dissatisfied with the final responses, file an online complaint to the Banking Ombudsman, RBI (Reserve Bank of India).

- Before filing a grievance, must collect the information related to previously raised concerns with PhonePe and the reference number or acknowledgement receipt.

- Also, attach some most relevant proofs and documents belonging to the disputed case (if any)

Note – If the concerned complaint belongs to Stock Market & Securities, complain with SEBI (Securities and Exchange Board of India). For the UPI disputes and issues, the complaints will be resolved by the NPCI (National Payments Corporation of India).

Tips – The Aadhaar eKYC and consent revocation-related issues of Merchants will be redressed by PhonePe individually. For this, contact the PhonePe Merchant support team. Based on the issues of onboarding or consent revocation, the resolution process will take 5 to 30 days (TAT).

PhonePe Customer Care Number

Need help from a customer care representative? Call the PhonePe customer representative through the toll-free customer care number, (helpline), e-mail your concerns, or message via WhatsApp to resolve the complaints.

Must provide this information:

- Name of the customer/merchant client

- The nature of the complaint

- A brief description of the issue with PhonePe services

- Details of any relevant proof or screenshots of technical problems (if required)

Note – Don’t share your personal, financial, or sensitive information with any customer care agents or even with PhonePe officials. Always be aware and protect yourself from fraud, scams, and unusual activities.

PhonePe Customer Helpline Number to Complain the Disputed Issues and Problems with PhonePe Pvt. Ltd:

| PhonePe Services | Customer Care Number |

|---|---|

| PhonePe complaint number | +918068727374, +912268727374 |

| PhonePe Business Merchant support | +918068727777, +912268727777 |

| Corruption/ ethics helpline | 18001021482 |

| E-mail (to report corruption) | ethics@phonepe.com |

| E-mail (Merchant) | merchant-desk@phonepe.com |

| PhonePe officials’ contact details | Click to contact |

Have you submitted your complaint? Yes! Have you noted down the reference/ticket number? Maybe you have done it. So, use it for escalation if not satisfied with the resolution with PhonePe customer support.

Note – Has the complaint not been resolved within 3 business days? Have you not been satisfied with the final redressal? In these circumstances, escalate this grievance to the Nodal or Principal Nodal Officer of PhonePe Private Limited with the previous ticket number.

File an Online Complaint

The fast and easy way to raise a concern is digital or say online mediums of communication through the PhonePe app or website. So, file an online complaint to PhonePe customer support or technical team to resolve any unforeseen or critical issues including payment failure, refund, recharge, transfer of money, payment of bills, UPI, or other problems.

You may also register a complaint about issues of insurance, investment, mutual funds, and business solutions like payment gateways or merchant (PhonePe business) services of PhonePe Pvt. Ltd.

PhonePe has its own Global Anti-Corruption Policy for the PhonePe Group, you can report concerns of violation of ethical codes or corruption activities of the employees/members.

Required information to fill out the online complaint form:

- Account holder name, and communication details

- The subject of the complaint

- Reference/ticket number (if any unresolved previous complaints)

- Detailed information in the description form with references and issues of PhonePe services

- Attach supporting documents or screenshots (if any)

Details to register an online complaint with PhonePe (UPI) and PhonePe Business (Merchant):

| PhonePe online complaint registration | File a complaint |

| PhonePe Business support | Submit complaint online |

| E-mail (Merchant Aadhaar eKYC) | merchant-desk@phonepe.com |

| BBPS bill pay issues/disputes | Click Here |

| Report corruption/ethics | Report a concern |

Note – Not resolved? Are you not satisfied with the resolution? Don’t worry, escalate this complaint to the Nodal Officer with the reference/ticket number. Don’t forget to provide appropriate information regarding the reason for dissatisfaction.

If the dispute or issue belongs to BBPS (Bharat Bill Payments), escalate this matter by filing a complaint to BBPS with an acknowledgement receipt/reference number. Further, you may approach the NPCI with the details of the unsatisfactory resolution by BBPS.

Nodal Officer, PhonePe

The Grievance Officer is appointed by PhonePe Private Limited as per the rules of the Information Technology Act, 2000 (Government of India). If your complaints are not resolved by the customer care representatives within 7 business days (including level 1 & level 2), or dissatisfied with responses, escalate this disputed grievance to the appointed Nodal or Principal Nodal Officer of PhonePe.

Must Provide These Details to the Nodal Officer:

- Name, address, and communication details

- The subject of the complaint with reason

- Ticket/reference number of the previous complaint

- A detailed description of the issue with the reason for the dissatisfaction

- Information related to unresolved complaints and responses

- Attach supporting documents and screenshots (if required)

You may contact the Nodal officer by phone number, e-mail, or submit an online grievance form. Also, write a complaint letter to the officer with the required details and send it at:

| Grievance Officer | Principal Nodal Officer, PhonePe |

|---|---|

| Phone No. | 08068727374, 02268727374 |

| Web | File a grievance online (grievance.phonepe.com) |

| Address | Office-2, Floor 4,5,6,7, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru, Karnataka-KA, Pin- 560103. |

Have you submitted a grievance to the Nodal Officer? Note down the acknowledgement receipt detail to track the status and use it for future reference. If the grievance is submitted by postal mail, wait for 3 to 5 days to get a response.

Note – Not resolved within 30 days, dissatisfied? In this situation, file a complaint to the Banking Ombudsman, RBI with some mandatory details of pertaining issues with PhonePe services. For other complaints than banking, approach the concerned regulatory authority or quasi-judicial body.

Banking Ombudsman, RBI

Reserve Bank of India (RBI) has constituted a Banking Ombudsman where a banking customer care files a complaint about unresolved grievances or unsatisfactory resolutions. PhonePe Private Limited also follows the rules and regulations of RBI. If you are facing such issues and want to redress them, approach the Ombudsman.

Always provide true, genuine, and factual information with the previously submitted complaints to PhonePe nodal officers. Visit the link below to raise your concerns with Banking Ombudsman.

Click – File an online complaint to Banking Ombudsman, RBI

Other Regulatory Bodies:

Have complaints about insurance, investment (stock market, or consumer rights? For these disputes with PhonePe, you should approach these regulatory bodies of the government:

- SEBI (Securities and Exchange Board of India)

- PFRDA (Pension Fund Regulatory and Development Authority)

- Ombudsman, IRDAI (Insurance Regulatory and Development Authority of India)

- NHB, National Housing Bank

- NCDRC (National Consumer Disputes Redressal Commission)

Note – Not satisfied with the final resolution of the Banking Ombudsman? Take help from legal experts and know the available legal ways to resolve the disputed case. This will help you to take legal action within specified law and you may approach the judicial authorities (session court or high court).

Frequently Asked Questions About PhonePe Pvt. Ltd.?

Q. What is the customer care number of PhonePe?

A. Dial the customer support numbers +918068727374, and +912268727374 of PhonePe to raise your concerns. The merchant or business owners can call +918068727777, and +912268727777 to report their concerns.

Q. Where can I register a complaint if my issues are not resolved by a customer representative of PhonePe?

A. In this condition, escalate the unresolved complaint by writing, the online grievance portal, or sending an e-mail to the Nodal/Principal Nodal Officer, PhonePe Private Limited. You may expect the final decision of the officer within 7 business days.

Q. Where can I approach if my complaints are not redressed by PhonePe Nodal officers?

A. You should file a complaint to the Banking Ombudsman, RBI. Approach the Ombudsman only after the expiry of the given resolution time (30 days) to the banking/digital financial service providers. In this case, If the given resolution period exceeds then surely you should raise your disputed matter before the Banking Ombudsman with some required information.