Indian Bank (IB) is a public sector bank owned by the Government of India. The amalgamation of Allahabad Bank with Indian Bank was completed in 2019. The bank officers various banking and financial services including subsidiary services of Indian Bank Mutual Fund.

Some products are loans, deposits, digital banking (UPI, online payments), and business/merchant banking (POS, payment gateways, etc.) including investment, insurance, and mutual fund.

| Notice - Be alert! Don't share the financial or banking details and don't share OTP to customer care executive. Protect yourself from Frauds and Scams. Report to Cyber Crime Bureau or Call 1930 as soon as possible to protect your earnings and others. |

Want to complain about the banking services of Indian Bank? To resolve your issues, file your complaint to Indian Bank customer care through the toll-free number, e-mail, and WhatsApp. Also, lodge your banking complaint online by SPGRS.

Still, not been resolved within 7 days? If you are dissatisfied with the response, escalate the complaint to the Zonal Manager of the Zonal Office and further to the FGM Office of the Indian Bank.

Dissatisfied with the final resolution of the Zonal/FGM Office? Escalate the disputed matter to Principal Nodal Officer, Indian Bank.

Note – Finally, if your disputed case is not resolved within 30 days or dissatisfied with the final redressal of the bank, lodge your complaint online against Indian Bank to the Banking Ombudsman, RBI (Reserve Bank of India).

How to File a Complaint to Indian Bank?

According to the Citizen Charter of the Indian Bank, the grievance redressal mechanism has 3 levels. At each level, an Officer is appointed to resolve the complaints related to banking or staff.

Report the problems related to bank accounts, investment, and corporate banking services with the designated officers under the given guidelines. If not satisfied with services, escalate the matter to the next authorized officers of the customer service department of the bank.

Complaint Resolution Period and Fees:

| Registration Fees | No Charges (₹0) |

| Resolution Period | 30 days (read the grievance redressal policy, Indian Bank) |

| Refund (auto transaction failures) | Within 7 working days (read customer experience & compensation policy of the bank) |

Each time, after successful registration of your complaint, note down the reference or acknowledgment details to track the status and use it to escalate the matter (if not resolved).

3 Levels of lodging complaints:

- Level 1: Lodge your complaint to:

- Customer Care (Toll-free number/Email/WhatsApp)

- Online Complaint (SPGRS)

- Branch Manager (Written complaint)

- Level 2: Zonal Office, Indian Bank

- FGM Office

- Level 3: Principal Nodal Officer, Corporate Office of Indian Bank

In the final stage, if your complaints are not resolved within 30 days by the bank or dissatisfied with the final resolution of the Nodal Officer of Indian Bank then file your complaint online against the bank to the RBI Banking Ombudsman with reference and facts.

Grievance Redressal Levels and Resolution Time Frame:

| Redressal Level, Indian Bank | Stipulated Time Limit |

|---|---|

| Branch Office/Online Complaint (SPGRS) | 7 days |

| Zonal Office Level | 8 to 11 days |

| FGM Office Level | 12 to 16 days |

| Nodal Officer, Corporate Office | Above 16 days (up to 21 days) |

The maximum period for the resolution and reply of the complaint is decided by the bank is 21 days. Further, this may take up to 30 days. If this period exceeds, approach the RBI Banking Ombudsman.

Indian Bank Customer Care Number

Customers can dial the toll-free customer care number of Indian Bank or WhatsApp to raise concerns related to banking services like unauthorized transactions, account issues and internet banking, payment failures, rejection of loans/delay in approvals, corporate/ business banking, and many more disputes.

Are you ready to call customer care through the toll-free helpline number? You can also request a callback by filling out the online complaint form (CGRS). While registering your complaint, provide the following information:

- Name of the complainant with contact details

- The subject of the banking complaint

- Description of the issue with relevant facts

Suggestion – Do not disclose any financially or personally sensitive information including OTP and banking details to the customer care representatives and protect yourself from cyber fraud/scams.

Toll-free Indian Bank customer care number and helpline to submit a banking complaint:

| Indian Bank complaint number | 180042500000 |

| WhatsApp Number | +918754424242 |

| Credit Card customer care number | +914425220903 |

| Email (security alert) | ebanking@indianbank.co.in |

| SMS (Block transactions) (SMS “BLOCK”) |

+919231000001 |

| NRI customer support | ibnridesk@indianbank.co.in |

| Email (credit card) | creditcard@indianbank.co.in |

If your complaints are not resolved within 7 days or dissatisfied with the final response of customer care then escalate the matter to the Zonal /FGM Office, Indian Bank.

Additionally, you can approach the Branch Manager of the nearest branch office of the bank. If the dispute is not resolved immediately, write a complaint letter to the Manager and take acknowledgment receipt as proof of submission.

Alternatively, customers can also file a complaint online through the CGRS complaint form with some required details.

File a complaint online

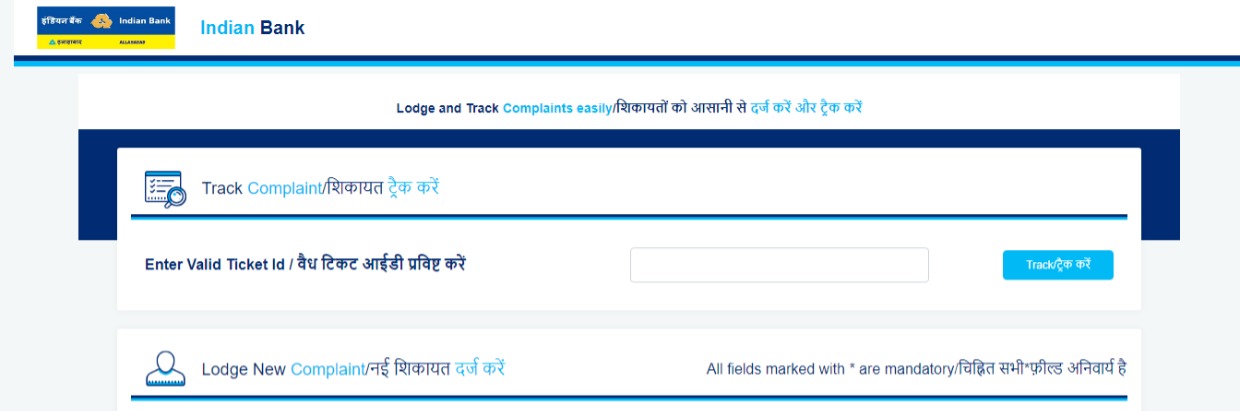

The Customer Grievance Redressal System (CGRS) is an integrated online complaint registration mechanism of the Indian Bank. As per the grievance redressal policy of the bank, you can file your banking complaints online by just filling out the online form and can track your status.

Not resolved? Don’t worry. If your complaints are not resolved or dissatisfied with the response, you can re-open the previous complaint online by using the reference number within the given resolution period (21 days). Then, escalate this disputed matter to the Zonal/FGM Office.

To submit an online complaint, provide these details:

- Name of the complainant, mobile number, and account no.

- Category of product/service and nature of the complaint

- Description of the complaint with branch details and relevant facts

- Attach supporting documents

After filling out the online complaint form, submit it and note down the reference/ticket id to track the status. You will get notified by the bank on your mobile number/email with an acknowledgment receipt (ticket id) as proof of successful submission.

Details to lodging online complaint to Indian Bank:

| Indian Bank (Online Complaint) | File your complaint |

| Track status/Request callback | Click Here |

| customercomplaints@indianbank.co.in | |

| Lodge grievance (ex-gratia payments) | Register now |

| Contact the nearest branch office | Click Here |

| Email (NRI customers) | ibnridesk@indianbank.co.in |

Have your complaints not been resolved within 7 days or dissatisfied with the online customer support of Indian Bank? You should escalate this complaint to the concerned Zonal or FGM Office and further to the Nodal Officer of your zone.

Alternative ways to submit a complaint:

| @myindianbank | |

| @MyIndianBank | |

| IndOASIS App | Android | i OS |

Want to access online Internet banking or other banking services? Visit IndNetBanking to use the digital banking products and services of Indian Bank. Still, have any doubts or queries? Approach the designated officers as mentioned below.

Zonal Officer, Indian Bank

If your submitted complaints are not resolved within 7 days online or any other means of communication by the bank in level 1 like customer care or branch office or dissatisfied with the final redressal then escalate your disputed case to the Zonal Manager of the Zonal Office of Indian Bank.

Must provide these details by email, online complaint form, or a written complaint to Zonal Officer at the concerned Zonal Office:

- Acknowledgment receipt/ticket id of submitted complaint

- Reason for dissatisfaction (if received a response)

- Description of the disputed matter and the relief expected from the officials

- Attach supporting and relevant documents with facts

Send your complaint to Zonal Manager, Indian Bank at:

Reference: The list of Emails of Zonal Offices of the Indian Bank

Still, have not satisfied? Also, if your complaint is not resolved within 4 days then escalate this disputed matter to the appointed Nodal Officer of the bank.

Principal Nodal Officer, Indian Bank

The Principal Nodal Officer is appointed by the Indian Bank under the RBI Integrated Ombudsman Scheme, 2021, to whom customers can escalate unresolved or unsatisfactory complaints with reference details of previous unresolved complaints.

So, if you also have any unresolved complaint that is pending more than 15 days to Zonal Officer or customer care team, escalate this disputed case to the designated Nodal Officer.

Must include these details while filing your complaint online or by e-mail/written letter:

- The ticket id/acknowledgment receipt or reference number

- Name and contact details of the customer/complainant

- Nature of complaint

- Description of the issue with the reason for dissatisfaction (if any)

- Attach supporting evidence, document, or any image as proof

Send your complaint letter to lodge a complaint to Nodal Officer at:

1. Principal Nodal Officer of Indian Bank for Customer Service and Grievance Redressal:

| Designation | General Manager (KYC/AML/CSC), Indian Bank |

| Phone No. | +914425279971 |

| nodalofficer@indianbank.co.in | |

| Address | Principal Nodal Officer, Indian Bank, Head Office, No. 66, Rajaji Salai, Chennai – 600001. |

Additionally, you can complain to the Nodal Officer of Zonal Offices of your region to resolve disputes with the bank.

If you are not satisfied with the final order then escalate the case to the Internal Ombudsman of the Indian Bank under the Integrated Banking Ombudsman Scheme.

Internal Ombudsman:

| Designation | Internal Ombudsman, Indian Bank |

| io@indianbank.co.in | |

| Address | Internal Ombudsman, Indian Bank, Head Office, No.66 Rajaji Salai, Chennai – 600001. |

Note – Yet not resolved or dissatisfied with resolution? Finally, if you are not satisfied with the final resolution of the Nodal Officer or the complaint is not resolved within 30 days by the bank then lodge a complaint against the Indian Bank to RBI Banking Ombudsman with relevant references.

Banking Ombudsman, RBI

As per the guidelines and rules of the Reserve Bank of India Integrated Ombudsman Scheme, 2021, if your complaints related to banking and financial services are not resolved within 30 days by the Indian Bank, you have the right to lodge a complaint against the bank to RBI Banking Ombudsman.

Additionally, you can also approach the Internal Ombudsman (IO) of the Indian Bank as mentioned above. Must provide these details to the Ombudsman:

- The reference/grievance id or acknowledgment receipt

- Name and contact details of the complainant

- Description of the issue with reasons and facts

- Attach supporting evidence and documents

You can email or lodge your complaint online by visiting the link below.

Click: File your complaint to Banking Ombudsman, RBI

Still, dissatisfied with the final order of the Banking Ombudsman? You may approach the concerned statutory or judicial body like legal courts or start an arbitration with the help of a legal expert.

Have complaints about Mutual Funds, Insurance, Securities (Stock Market), etc? Don’t worry. You may raise your issue to the concerned regulatory authorities of the government:

- For disputes about the stock market and securities, approach the Securities and Exchange Board of India (SEBI)

- For cases of pensions, complain to Pension Fund Regulatory and Development Authority (PFRDA)

- For issues of insurance, report to Insurance Ombudsman, IRDAI

- For housing loans, approach the National Housing Bank (NHB)

Additionally, if you are facing any form of harassment by the employees/staff/officer of the bank or have any complaint about bribery or corrupt activities then you can file your complaint online through CPGRAMS (Central Government) to the Head of Indian Bank.

Issues to be resolved

These are some banking and financial services offered by the bank and related issues that can be resolved by the Indian Bank:

Category – A (High)

- Allegations of misbehavior, harassment, and corruption

- Delay in disposal of deceased cases or pension related matter

- Complaints received from the Ministry of Finance (MOF), Directorate for Public Grievances (DPG), RBI/BCSBI, Members of Parliament (MPs), Members of Legislative (MLAs), and other Regulators or Govt. organizations.

- Issues related to failure payment transactions, unauthorized transactions, or urgent matters related to banking disputes or technical problems

Category – B (Medium)

- Dispute regarding application/charging of interest or service charges (credit & deposit) for credit & deposit

- Credit related matters like Sanction, Disbursement, Recovery, EMI, etc.

- Disputes related to Loss/ Misplacements of Instruments or security/ Title Deed

- Cheque /DD/IOI-related issues or payment matters

- Delay in the transfer of account from one branch to another (exceeding the time limit)

Category – C (Others)

- For the cases of Inadequate infrastructure/ sitting arrangement, ambiance, etc.

- Premises related disputes

- Fund Remittance through a branch (RTGS/ NEFT/ IMPS)

- ATM, Internet Banking, and Mobile Banking related matters

- General Banking operations, Bank Employees, and Customer Service issues

- Other matters that are not listed above

Loans

Issues related to Bank Loans from Indian Bank:

- Disputes related to loan products like agriculture and personal/individual loan

- Policy on Co-Lending by Banks & NBFCs to Priority Sector

- Business Loans: Matters of MSME, Corporate, and NRI loans

- Concerns related to approval and rejection of Education and 59 Minutes loans

- Issues with online loans

Accounts & Deposits

Issues related to Accounts & Deposits:

- Problems related to savings bank accounts, current accounts, and term deposits

- Any concerns with NRI accounts and banking transactions including e-services/internet banking

Digital Banking

Issues related to Digital Banking:

- Digital products & banking services of Indian Bank like IndOASIS, SMS banking/ missed call service, Internet banking, and WhatsApp banking

- Issues of Ind QwikCollect, NETC FASTag, and e – Shopping

- Complaints related to Debit/Credit Cards and National Common Mobility Cards (NCMC)

- Problems related to Mutual Funds, IPO, Demat & Trading, and UPI through USSD

Merchant Digital Products

Issues related to Digital Banking Products:

- Point of Sale (PoS), Merchant UPI QR Code, BHIM Aadhaar Pay, and online collection products

- Other concerns regarding the merchant or corporate digital payment solutions

Frequently Asked Questions about Indian Bank

Q. What is the customer care number of Indian Bank to register a banking complaint?

A. Dial the toll-free Indian Bank customer care number 180042500000 or WhatsApp at +918754424242 to lodge your complaint. You may also email ebanking@indianbank.co.in to raise your concerns and security alerts to the bank.

Q. Where can I approach If my complaints are not resolved by the customer care of Indian Bank?

A. First, you can escalate your complaint to the Zonal Officer of the Indian Bank. Further, if your complaint is not resolved within 15 days (including customer care) then escalate your disputed matter to Principal Nodal Officer, Indian Bank.

Q. What can I do if my submitted complaint is not resolved or I’m not satisfied with the response of the bank?

A. In this case, if your complaint is not resolved within 30 days by Indian Bank, lodge a complaint against the Indian Bank to RBI Banking Ombudsman.